Pre-Mortgage Security Property Valuers

What is a Pre-Mortgage Security Property Valuation?

A pre-mortgage security property valuation is completed to establish one’s current financial standing before seeking out a mortgage lender. While a pre-mortgage security valuation is not something that is required with a bank, it will determine the current market value of the property in preparedness for when a mortgage lender is approached.

How can we help?

Our team of independent property valuers are all certified with the Australian Property Institute (API) to guarantee that all reports adhere to API standards and guidelines. Having an independent, locally based property value complete a property valuation will ensure that well-researched unbiased report.

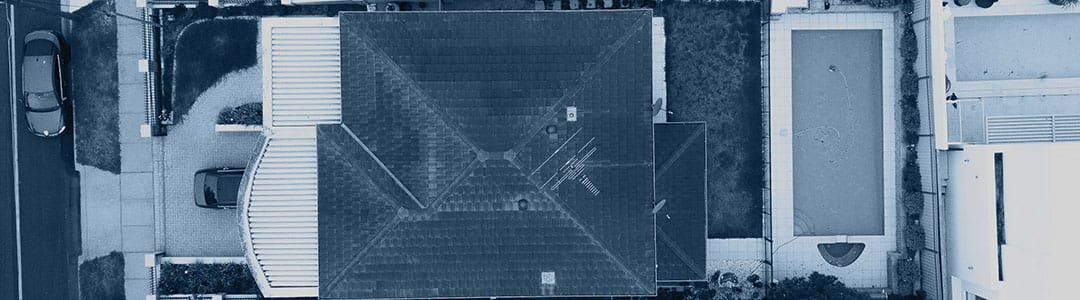

At Valuations VIC, our expert property valuers take into account factors such as current market conditions, comparable prices and environmental factors. In addition, our reports are also based on internal factors such as property type, size, facilities and location.

Having a pre-mortgage security property valuation completed by an independent property valuer will ensure that you’ll receive a valuation report based on the current market value.

If you have any queries on how we can help you with your compensation valuation report, please contact us on (03) 9021 2009 or complete an online form.